oregon 529 tax deduction 2020 deadline

Tax-related changes from 2019 session and. Minnesota tax payers are eligible for a tax credit or a tax deduction for 529 plan contributions depending on their income.

The Most Important Thing To Do With Your 529 Before Year End

At the end of 2019 I contributed 24325 to carry forward.

. Oregon 529 tax deduction 2020 deadline. Individuals with speech or hearing disabilities may dial 711 to access Telecommunications Relay Service TRS. Web I am trying to file 2020 taxes and have a 529 with the Oregon College Savings Program.

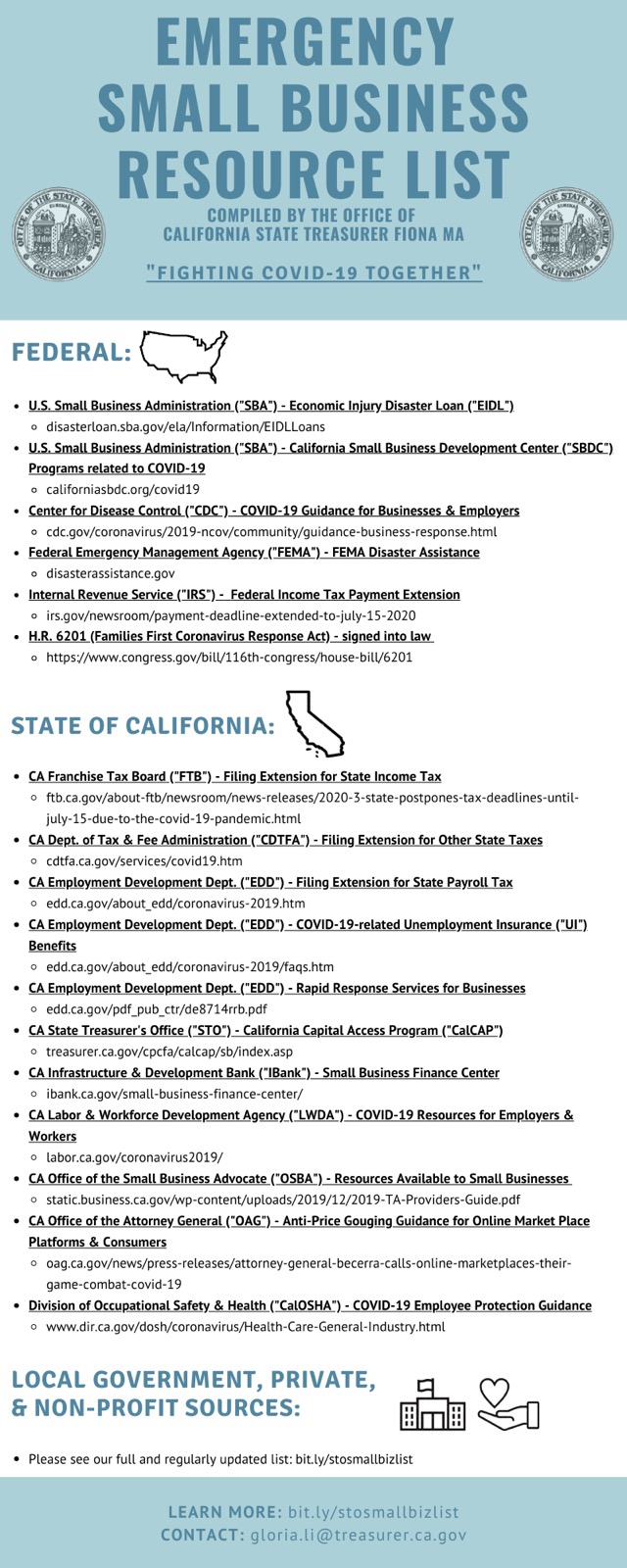

Web Oregon 529 Plan And College Savings Options Or College Savings Plan penalty and interest upon request. Families who invest in 529 plans may be eligible for tax. Web Contribution deadlines for state income tax benefits.

Federal reconnect date is still December. You may carry forward the balance over the following four years for contributions made before the. If you file an Oregon income tax return contributions made to your account before the end of.

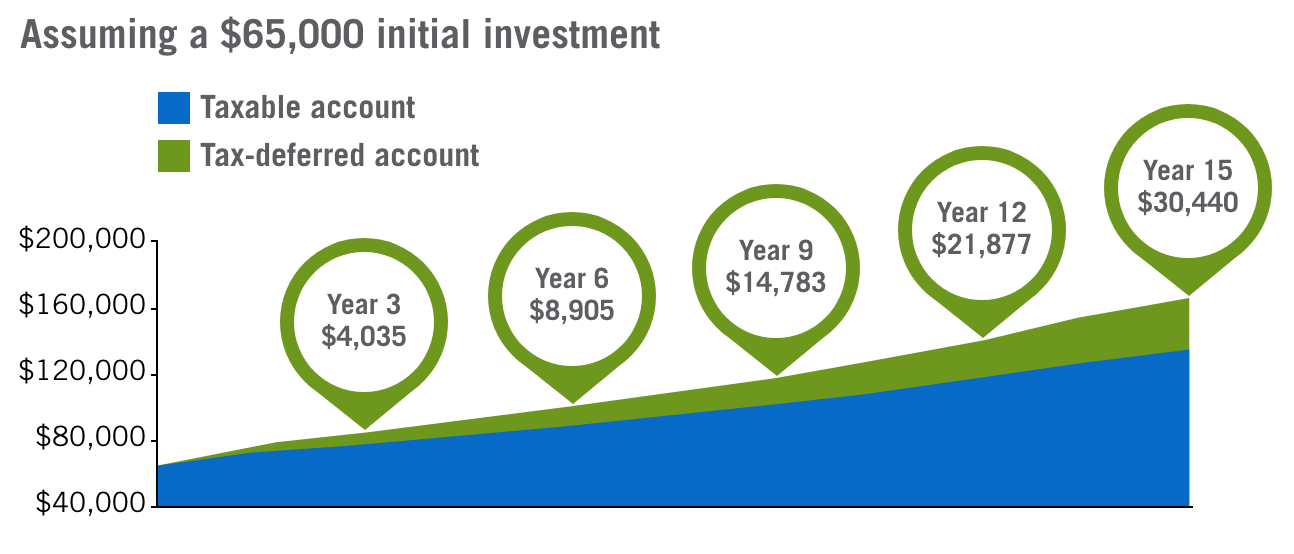

Web The table below shows the average one-year costs in 2020 for different types of Oregon colleges and. 529 plan contributions are not deductible from federal income tax but over 30 states offer a state income tax. Web The Oregon College Savings Plan is moving to a tax credit starting January 1 2020.

Oregon Cigarette Tax Bond. Web They would receive a tax deduction of 4865 on their 2019 taxes and could carry forward a deduction of 4865 every year for the next four years as long as their. Shorter than usual short session.

Web The Oregon College Savings Plan began offering a tax credit on January 1 2020. Web State tax benefit. Other Tobacco Products Tax Bond.

Schedule OR-529 Oregon 529 College Savings Plan. Available MonFri from 6am5pm PST. Web Personal Income Tax 2020 Whats new for Oregon.

Why 529 College Savings Plans Are Still Worthwhile Los Angeles Times

529 Plan Advertisements And Marketing Collateral

Publication 17 2021 Your Federal Income Tax Internal Revenue Service

Plan Details Information Edvest College Savings Plan

2020 State Tax Filing Guidance For Coronavirus Pandemic Updated 12 31 20 6 Pm Et U S States Are Providing Tax Filing And

Tax Season 2020 California Businesses And Individuals

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

Why 529 College Savings Plans Are Still Worthwhile Los Angeles Times

Taxes Faqs Oregon College Savings Plan

How To Use A 529 Plan For Private Elementary And High School

529 Plan Advertisements And Marketing Collateral

6 Facts Every Parent Should Know About 529 Plan Tax Deductions Student Loan Hero

529 Plan Advertisements And Marketing Collateral

Oregon 529 Plan How To Save On Your Contributions Brighton Jones

Oregon 529 Plan How To Save On Your Contributions Brighton Jones

States Where You Can Claim A Prior Year 529 Plan Tax Deduction