haven't filed taxes in 5 years what do i do

An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances. However you can still claim your refund for any returns.

Apply For Medicaid Snap Other Benefits Over The Phone Medicaid How To Apply How To Find Out

For each return that is more than 60 days past its due date they will assess a 135 minimum failure to.

. For example if you need to file a 2017 tax return. For eligible individuals the IRS will still issue the payment even if they havent filed a tax return in years The quickest way to. The criminal penalties include up to one year in.

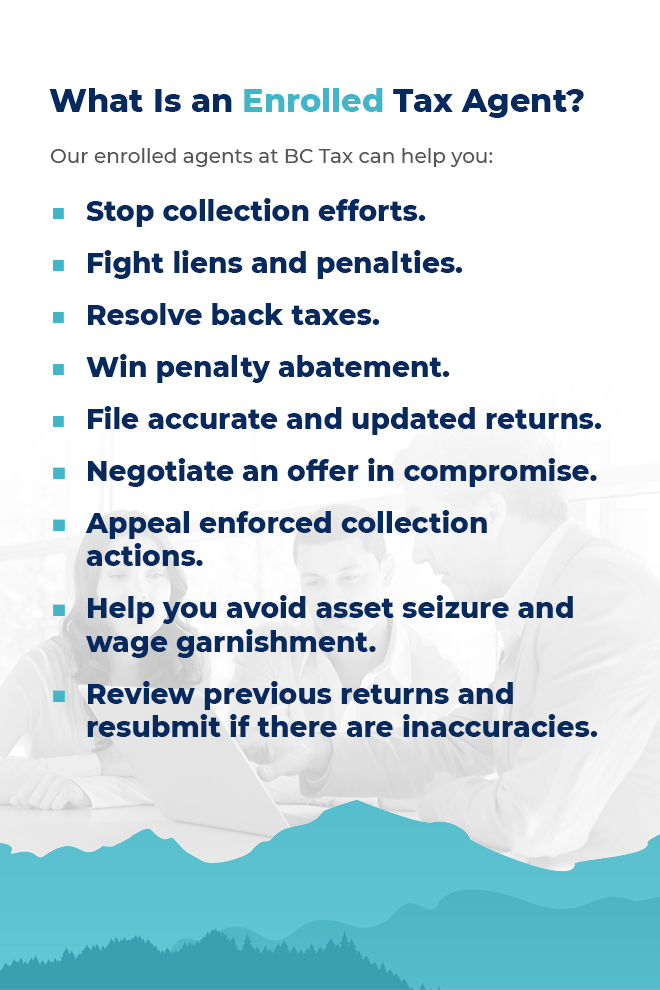

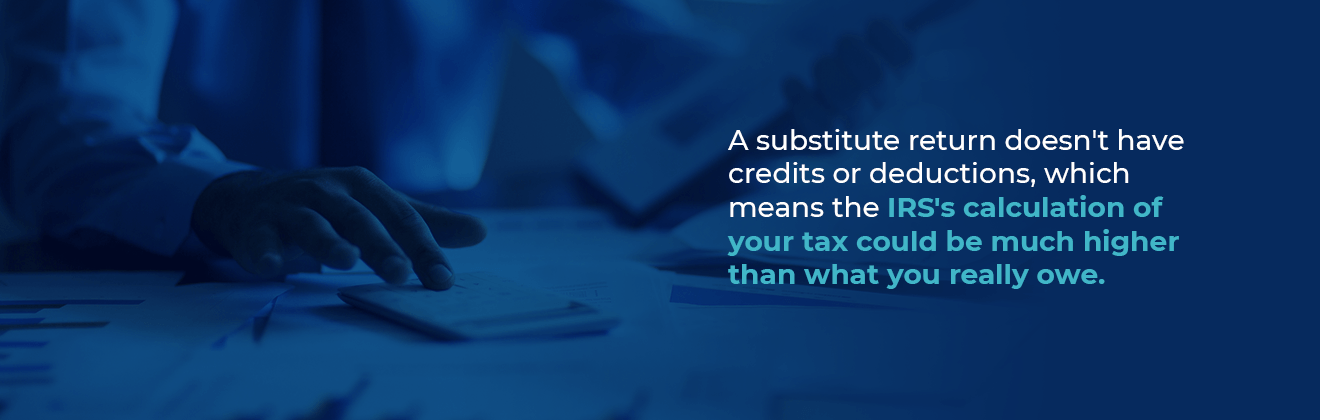

Other times they will go ahead and prepare tax returns for you using only income or revenue information that they have on file going back several years and then send you a HUGE. That said youll want to contact them as soon as. Ive worked in three restaurants and I sold Cutco for a year and then ran an office and.

Click on the Request Admin Penalty SOA tab. To file a return for a prior tax year. This penalty is 5 per month for each month you havent filed.

Penalties include up to one year in prison for each year you. If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible. Contact the CRA.

This helps you avoid. What happens if you havent filed taxes for several years. If you dont file a tax return you will be in violation of the law.

Select a year in which your tax returns were outstanding and then click. What happens if I havent filed taxes in 5 years. If you need to prepare a return for 2017 2018 or 2019 you can purchase and download desktop software to do it then print sign and mail the.

As soon as you miss the tax deadline typically April 30 th each year for most people there is an automatic late. 415 64 votes If you fail to file your taxes youll be assessed a failure to file penalty. The timeframe for claiming a refund is normally three years after the tax return is filed or two years after the taxes are paid.

This penalty is 5 per month for each month you havent filed up to a maximum of. If you owed taxes for the years you havent filed the IRS has not forgotten. Tax evasion in California is punishable by up to one year in county jail or state prison as well as fines of up to 20000.

This is because the CRA charges penalties for filing and paying taxes late. Click on the SARS Correspondence tab on the left. Its too late to claim your refund for returns due more than three years ago.

The penalty charge will not exceed 25 of your total taxes owed. After the expiration of the three-year period the refund. If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure Program as soon as possible.

They will then mail you a letter known as an. If you havent filed a tax return in a few years the IRS will pull your tax documents from those years and use them to calculate your tax. Havent Filed Taxes in 5 Years If You Are Due a Refund.

This penalty is usually 5 of the unpaid taxes. If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign. What happens if you havent filed taxes in 5 years.

In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes. Then you have to prove to the IRS that you dont have the means to. I havent filed my taxes since 2009.

Return to that part of the process in your. What should I do if I havent filed taxes for 10 years. If you fail to file your taxes youll be assessed a failure to file penalty.

Will I get a stimulus check if I havent filed taxes in 5 years. The state can also require you to pay your back taxes and it. I recently filed my 2019 taxes but they were rejected because the AGI I gave them didnt match with the number on my non-existent 2018 tax return.

If youre required to file a tax return and you dont file you will have committed a crime. 16 votes 12 comments. But if you filed your tax return 60 days after the due date or the.

I Haven T Filed Taxes In 5 Years How Do I Start

Get Ahead Of The Tax Filing Game In 2022 Filing Taxes Tax Deadline Online Taxes

Why Women Should Become Cfp Professionals Top 5 Reasons Excel For Beginners Millennial Women Women

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

/GettyImages-1367788813-3e9f601f07874706bca823305a2b4015.jpg)

Taxes What To Do If You Haven T Filed

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Build Your Empire Top Entrepreneurs Quotes Wisdom

Medicare Part D 2021 Medicare How To Plan Medicare Advantage

5 Tax Preparation Tips Every Entrepreneur Should Know Tax Preparation Tax Deductions Tax

Tax That Is Imposed By The Government Directly On The Both Earned And Unearned Annual Income Read More Income Tax Return Tax Return Income Tax

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

I Haven T Filed Taxes In 10 Years Or More Am I In Trouble

Paper Organization Bundle File System Bundle Paper Etsy Filing System Life Binder Paper Organization

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Pin On Healthy Freelance Living